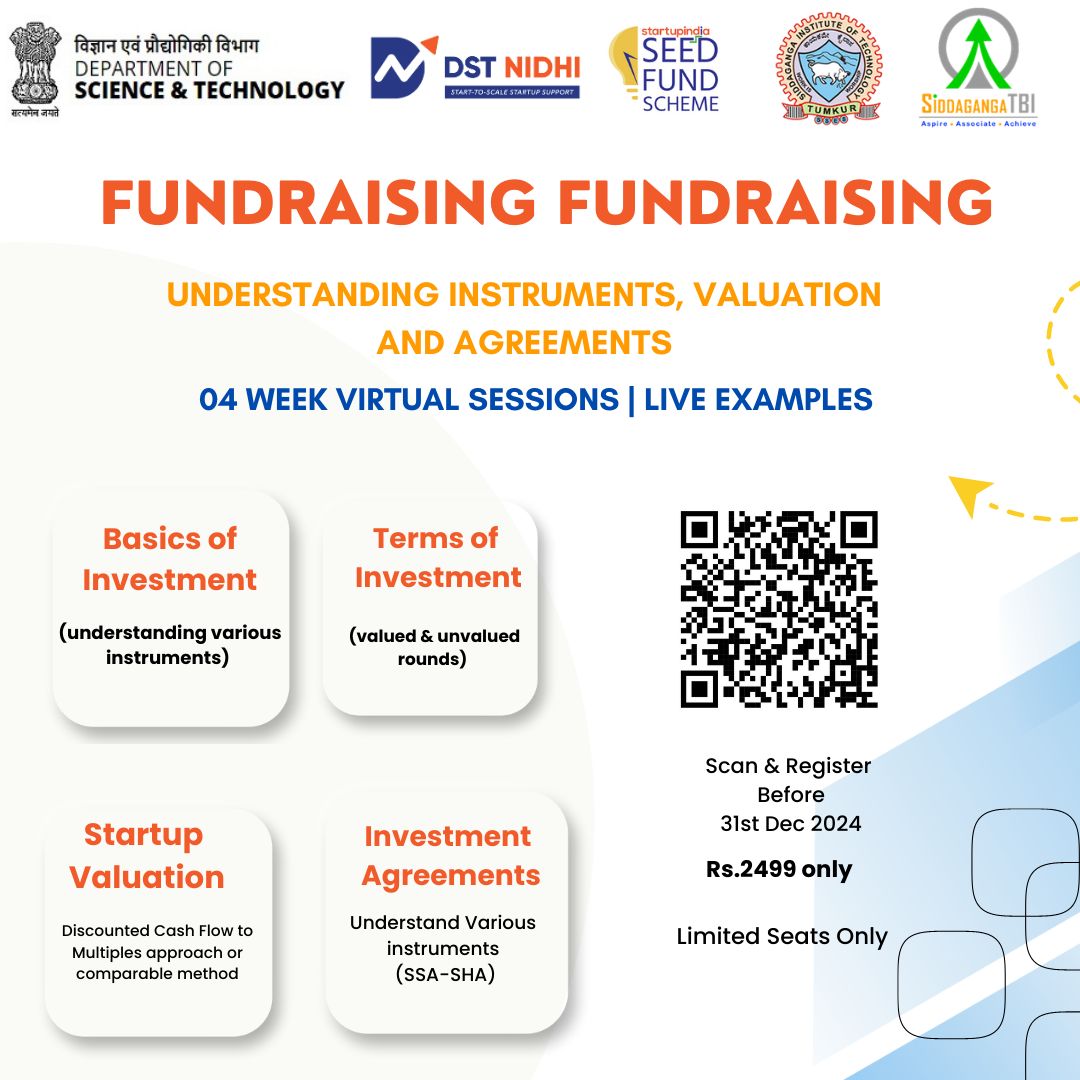

Fundraising - Understanding Instruments, Valuation and Agreements

Apply NowBasics of Investment - Understanding Various Instruments

This lecture is designed for anyone eager to grasp the essentials of investment, focusing on key topics like Equity Instruments, Preference Shares, Debentures, and Convertible Notes. This session offers valuable insights into how these instruments work, their benefits, and how they fit into a successful fund raise strategy.

Terms of Investment - Valued Round and Unvalued Round

Every investment deal hinges on key terms, and understanding the difference between valued and unvalued rounds is essential for making strategic decisions. This session will guide you through the intricacies of structuring both types of rounds, shedding light on how investment terms shape the future of businesses and investors alike

Startup Valuations

Unravel the key methods used to determine the worth of a business. From Discounted Cash Flow to Multiples approach or comparable method, this session covers brief of all methods. Gain a understanding of these valuation techniques and their application in real-world scenarios.

Investment agreement

An in-depth session that unpacks the key clauses found in every investment deal, including Tag Along, Drag Along, Liquidation Preference, Promoter Lock-in, and more. Gain clarity on how these agreements shape the dynamics between investors and founders, safeguard interests, and pave the way for successful partnerships

Early Bird Offer

Register by 31/12/2024 at ₹2499/-

Bank Account Details for Payment

- Bank Name: Karnataka Bank Ltd

- Account No: 7682000100007501

- IFSC Code: KARB0000768

- Branch Address: SIT Campus Extn-Counter Branch

- Name of the Account: SIDDAGANGA INCUBATION FOUNDATION